GL Inquiry screens allow you to search for and display information about your department's original allocated budget and what the current balance is for each account. You can also drill down to see more detailed transactions for past expenditures as well as encumbrances for planned future expenses.

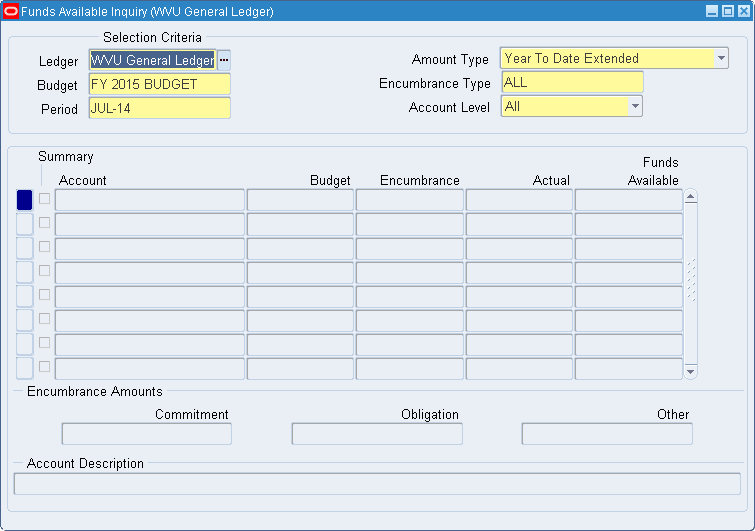

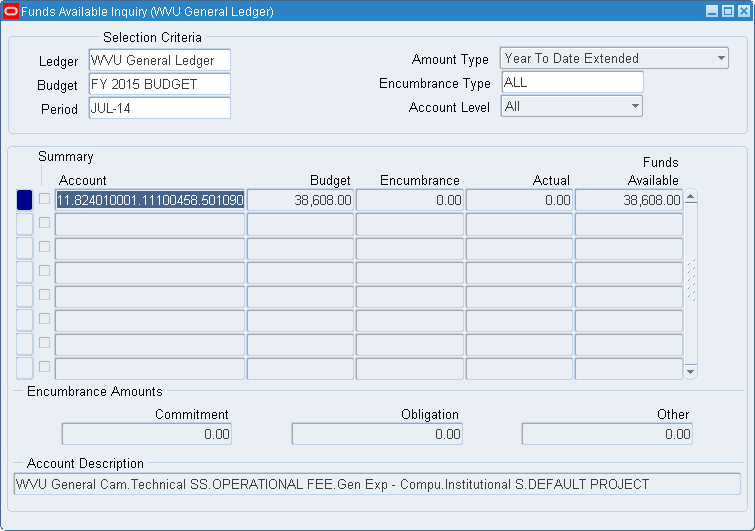

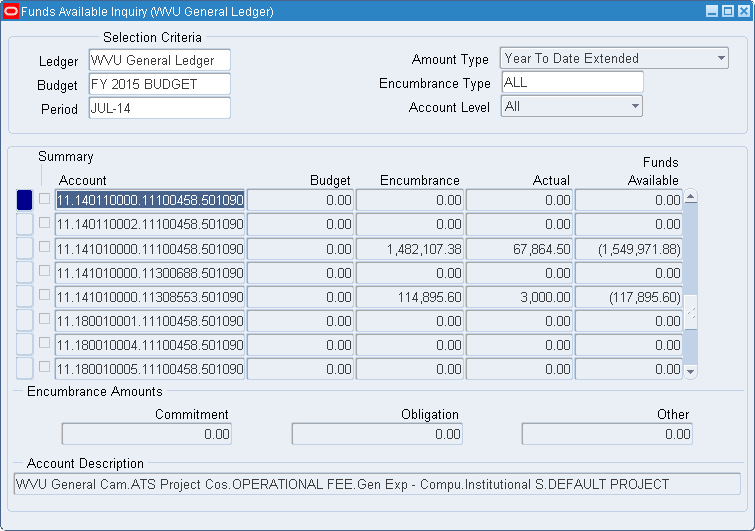

The GL View Funds Available Inquiry screen allow you to request budget and balance data for a combination of accounting string segments using the Find Accounts flexfield. Click in the Account field or click the searchlight icon on the tool bar to open the Find Accounts search screen. You can search for a specific account by completing all the segments of the accounting string, or you can leave some segments blank to search a wider range of accounts.

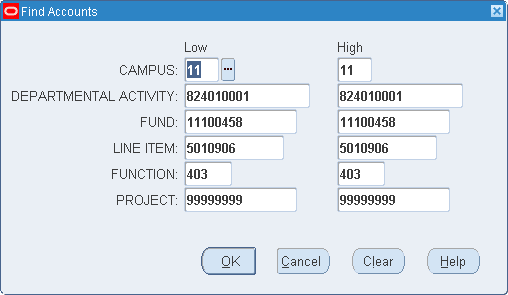

When you complete all segments in the Find Accounts screen, and Low and High fields are identical, only the individual record that matches your search is retrieved.

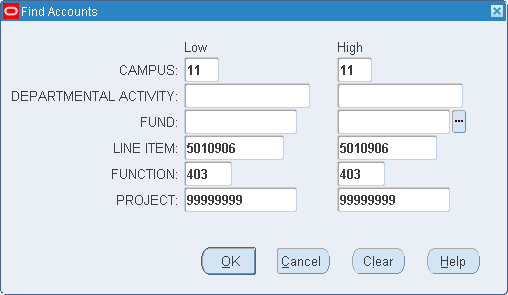

However, you are not required to complete all segments. You may complete only certain portions of the accounting string to find accounts that match your search criteria (such as any budgets linked to a certain Line Item and/or Function). You can always enter different search requirements in the Find Accounts box by clicking the 'search' flashlight icon in the toolbar.

In this case, records retrieved all have the same Campus, Line Item, Function, and Project Number. They may have different DA and Fund numbers.

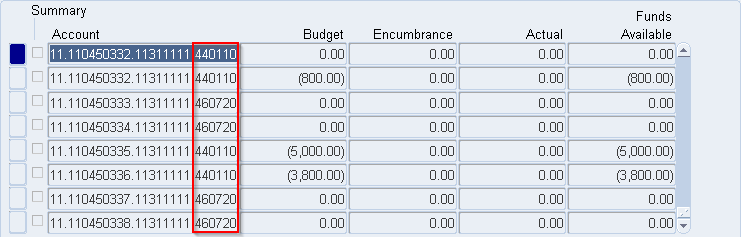

To use the Funds Available Inquiry screen to see revenue budgets, simply search for accounts with corrseponding revenue-based Line Items. The account inquiry results below show a search for line items ranging from 400000-499999 (revenue).

- Expenditure Budgets refer to the amount:

- - allocated when the funds are centrally controlled, or

- - the unit is willing to spend when the funds are controlled by the department

- Expenditure Encumbrances refer to the amount

- -“promised” to be spent (for purchases or payroll)

- Expenditure Actuals refers to the amount

- -actually spent (for goods, services, payroll)

- Expenditure Funds Available refers to the amount

- -available to be spent, or what's left of the original budget

For regular expenditure accounts, a budget is what you expect to spend during the fiscal year, while the actual amount is what has already been spent. Normally Budgets show money you already have and Actuals show money you have spent.

- Revenue Budgets refer to the amount:

- - expected to be received through income

- Revenue Actuals refers to the amount

- -actually received so far

- Revenue Funds Available refers to the amount

- -yet to be earned to complete the expected budgeted income

Revenue “budgets” refer to the amount expected to be received, while revenue “actuals” refer to the amount actually received so far. For Revenue accounts, the budget is displayed in brackets (showing a negative balance) to indicate they work backwards - money coming in instead of going out. Revenue budget amounts show projected income (rather than what you have to start with) and actuals are what you have actually brought in (instead of what you have spent).

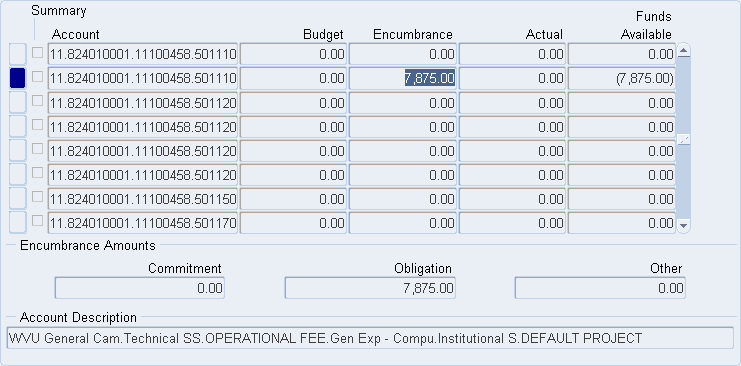

Encumbrances are promises to pay certain kinds of items later in the fiscal year. When expenditures are encumbered ahead of time, the budget inquiry screens and budget reports will show this money as ear-marked or set aside for those purchases. Even though the funds have not been spent yet, the encumbered amount is also deducted from the Funds Available column value, displaying that these funds are already committed.

Departments may choose to encumber some expenditures that they know will have to come out of the budget, such as payroll for staff, or Facilities &Administrative costs paid by the department as part of research agreements. Other types of expenditures create an encumbrance automatically when they are requested through the MAP system, such as creating a requisition or purchase order.

You can see how much money has been reserved for each category of encumbrances by reviewing the Encumbrance Amounts section at the bottom of the Funds Available Inquiry screen. When you click to select a budget line, the dollar values assigned to each type of encumbrance will appear there.

- Commitment

- - A MAP requisition (or WVUBUY purchase request) has been charged to this account; you have committed to pay for the purchase

- Obligation

- - the requisition has become a purchase order, and the order has been sent to the vendor; payment is now obliged

- Other

- - payroll is run in collaboration with the State of WV (outside of MAP); encumbered payroll shows as 'other'